does california have an estate tax in 2021

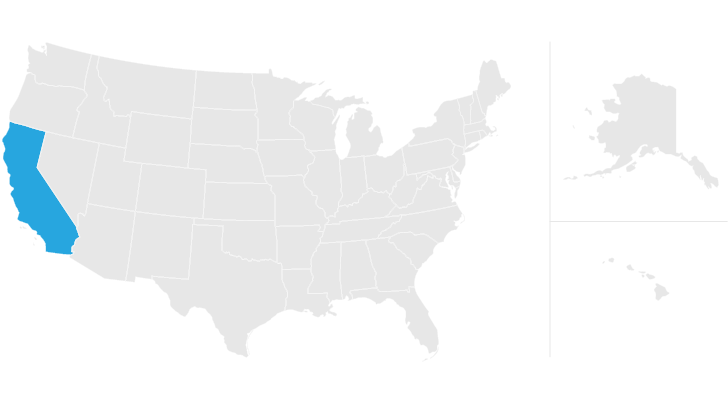

California has one of the highest average property tax rates in the country with only nine states levying higher property taxes. As of this time in 2021 California does not have its own state-level death tax or estate tax and has not had one.

Is Inheritance Taxable In California Law Offices Of Daniel Hunt

California does not levy an estate tax on any estates regardless of size.

. Here is a list of our partners and heres how we make money. 18 0 base tax 18 on taxable amount. California does not have an inheritance tax or a death tax in 2021.

The District of Columbia moved in the. Taxable amount estate value above the exemption Tax rate. The State Controllers Office Tax Administration Section administers the Estate Tax Inheritance Tax and Gift Tax programs for the State of California.

No California estate tax means you get to keep more of your inheritance. However the federal gift tax does still apply to residents of California. In most states that impose an estate tax the tax is similar to its federal counterpart.

Does California Impose an Inheritance Tax. Effective January 1 2005 the state. California does not levy a gift tax.

However California is not among them. There are a few exceptions such as the Federal estate tax. 2021-2022 Federal Estate Tax Rates.

Does California Have an Estate Tax. For example most states only tax estates valued over a certain dollar value. For 2021 the threshold for the federal estate tax is presently 117 million for individuals 234 million for married couples plain and simple.

This goes up to 1206 million in 2022. In fact few states do as of 2021 only 12 states and the District of Columbia impose an estate tax. Again as noted it is still important to put in place an estate plan so that your estate avoids probate.

For 2021 the annual gift-tax exclusion is 15000 per donor per recipient. What Is the Federal Estate Tax Threshold. If you are a beneficiary you will not have to pay tax on your inheritance.

Gift and Estate Tax. California state tax rates are 1 2 4 6 8 93 103 113 and 123. This tax has full portability for married couples meaning if the right legal steps are.

In the Tax Cuts and Jobs Act of 2017 the federal government raised the estate tax exclusion from 549 million to 112 million per person though this provision expires December 31 2025. The proposed California gift and transfer tax rate will be equal to the marginal federal transfer tax rate imposed on lifetime gifts and transfers at deathessentially a 40. Since then estate taxes have been a source of political controversy.

California does not have an estate tax. A 1 mental health services tax applies to income. Federal Estate Tax Rates 2020-2021.

Does california have an estate tax in 2021. California estate tax. Any tax changes enacted in 2021 could have retroactive effect making estate planning this year much more complicated.

A giver can give anyone elsesuch as a relative friend or even a strangerup. Deepest condolences in italian. 28 rate minimum tax of 15 on financial statement income.

The Economic Growth and Tax Relief Reconciliation Act of 2001 phased out the state death tax credit over a four 4 year period beginning January 2002. The federal estate tax goes into effect for estates valued at 117 million and up in 2021. If the property you leave behind to your heirs exceeds your lifetime gift and estate tax exemption of 114 million in 2019 or 1158 million in 2020 youd owe a federal.

What Is the Estate Tax. This amount is known as the estate tax exemption as any estate under 11700000 is excluded from the federal estate tax. Connecticuts estate tax will have a flat rate of 12 percent by 2023.

As of 2021 the deceased individuals estate is subject to the estate tax when their taxable estate exceeds 11700000. The current estate tax the tax rate on the excess value of an individuals estate is 40. California Estate Tax.

However an estate must exceed 1158 million dollars per person in 2020 to be subject to estate tax in the US. Generally speaking inheritance is not subject to tax in California. 0 base tax 18 on the taxable amount.

In 2020 rates started at 10 percent while the lowest rate in 2021 is 108 percent. 20 1800 base tax. As of 2021 12 states plus the District of Columbia impose an estate tax.

Vermont also continued phasing in an estate exemption increase raising the exemption to 5 million on January 1 compared to 45 million in 2020.

California Estate Tax Everything You Need To Know Smartasset

California Estate Tax Everything You Need To Know Smartasset

Is Inheritance Taxable In California Law Offices Of Daniel Hunt

California S 13 3 Tax On Capital Gains Inspires Move Then Sell Tactics Capital Gain Capital Gains Tax Tax

Proposition 19 Property Tax Reassessment Exemptions For 2021

Estate Of The Day 9 9 Million Mediterranean Mansion In Rancho Santa Fe California Casas De Luxo Casas Luxuosas Mansoes De Luxo

3800000 Encinitas Real Estate 183 La Costa Encinitas Ca 92024 Features 5 Beds 4 Bath 4135 Sq San Diego Real Estate San Diego Houses Resort Living

Hollywood Hills Home For Sale In 2021 Hollywood Hills Homes Glen Los Angles

707 Park Ln Santa Barbara Ca Spanish Style Homes Santa Barbara Style Homes Santa Barbara House

New California Homestead Exemption 2021 Oaktree Law

Is Inheritance Taxable In California Law Offices Of Daniel Hunt

Estate Planning Concept Vector In 2022 Estate Planning Financial Analysis Property Tax

25919 Dark Creek Rd Calabasas Ca 91302 Mls 19432772 Zillow Dream Properties Contemporary Farmhouse Property Design

California Property Taxes Explained Big Block Realty

There Are 9 Us States With No Income Tax But 2 Of Them Still Taxed Investment Earnings In 2020 Income Tax Income Tax Brackets

Https Www Forbes Com Sites Peterjreilly 2021 09 25 Time To Change Your Estate Planagain Estate Planning Estate Tax Grantor Trust

Is Inheritance Taxable In California Law Offices Of Daniel Hunt

California Estate Tax Everything You Need To Know Smartasset

Douglas Elliman California On Instagram Designed And Built By Renowned Los Angeles Celebrity Architect Roger Davis This Contemporary Architectural Gem Sits I